Standard Costing and Variance Analysis

Published in 2021

Introduction

Standard Costing, along with Variance Analysis, is a widely used cost and management accounting method. It originated in the initial decades of the 20th century and has since then evolved into an accepted method for recording, analysis and control of organisational costs.

Standard costing is essentially a cost control system that is based upon the fixation of the cost of products or services under existing conditions by business organisations and on their subsequent use to control the actual costs that are incurred by business organisations. Very briefly the fixed or predetermined costs serve as benchmarks or standards for comparison with actual post production costs. The variances between actual costs and standard costs enable managements to locate the variances and thereafter take appropriate corrective action.

Definitions

The standard costing process has over time evolved into a complex procedure with very clear theory and methods. Some key ICMA based definitions of standard costing, which are provided below, illustrate the important premises of the process.

A Standard Cost is a pre-determined cost that is computed in connection with a given situation of working conditions; it correlates both technical and scientific parameters of labour and material to the wages and prices that are likely to be applicable during the time frame for which the standard cost is determined, along with a suitable share of forecasted overheads.

Standard Costing is very simply the “preparation of standard costs of products and services.”

A Standard Hour is “a hypothetical unit pre-established to represent the amount of work which should be performed in one hour at standard performance”. This is a significant concept because it enables the measurement of production volumes of various products and services in terms of a common and standardised unit.

Variance Accounting represents a method wherein the planned actions of business firms are quantified through budgets made on the basis of standard prices and costs and the differences between such budgeted figures and actual results are periodically presented to management, along with analyses of the reasons for such variances, as well as details of those responsible for such variances.

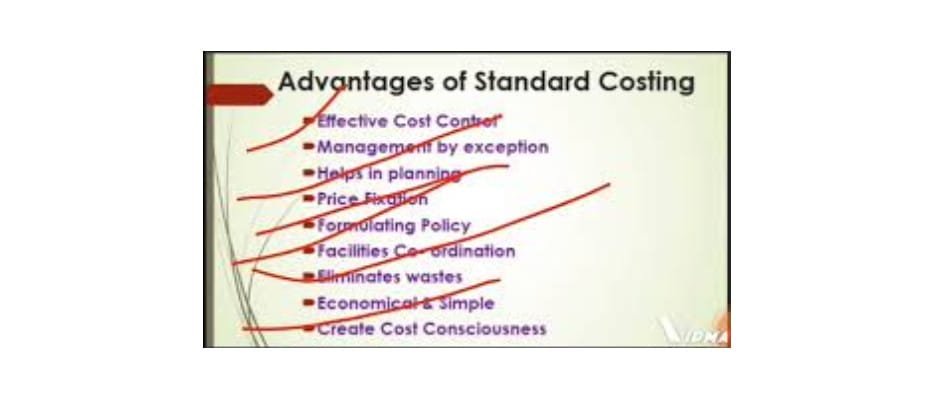

Applications and Advantages

The widespread acceptance of standard costing for a sustained period of time provides a categorical endorsement of its suitability for the standardised mass production based manufacturing activity that was characteristic of western businesses for much of the 20th century.

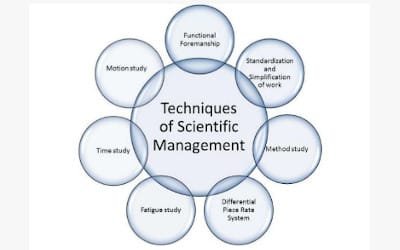

The system most importantly prompts managements to analyse existing costs in detail at the time of standard fixation. Such a multidisciplinary exercise helps in inculcating the importance of computing and controlling costs. The fixation of standards for various components of costs requires intense study of diverse business aspects, standards being set differently for expenses that concern manufacture, sales and administration. Such exercises lead to the adoption of methods like time and motion study and material control processes, all of which help in reduction of inefficiencies at various levels.

The fixation of responsibility centres helps in building accountability and seriousness in meeting cost and profitability objectives. The setting of clear targets provides transparency to organisational working and motivates employees to achieve standards.

The system is based upon clear logic because actual costs are compared with carefully prepared standard costs and not with figures of previous periods or other companies, which could be unsuitable for various reasons. Standards are of three types, basic, ideal and attainable. Whilst basic standards refer to those that are set for long periods of time and attainable to those that can be realistically achieved, ideal standards represent very high levels of efficiency and serve as difficult targets.

The periodic computation of performance variances, by cost head as well as responsibility centre, enables managers to regularly check actual costs, locate inefficiencies and take swift and suitable corrective action. With budgets being fixed by way of responsibility centres, the system makes it possible for managements from refraining from interference in satisfactorily functioning areas and focus on problems.

Constant analysis of variances enables managements to keep a check on the accuracy and reliability of the chosen standards.

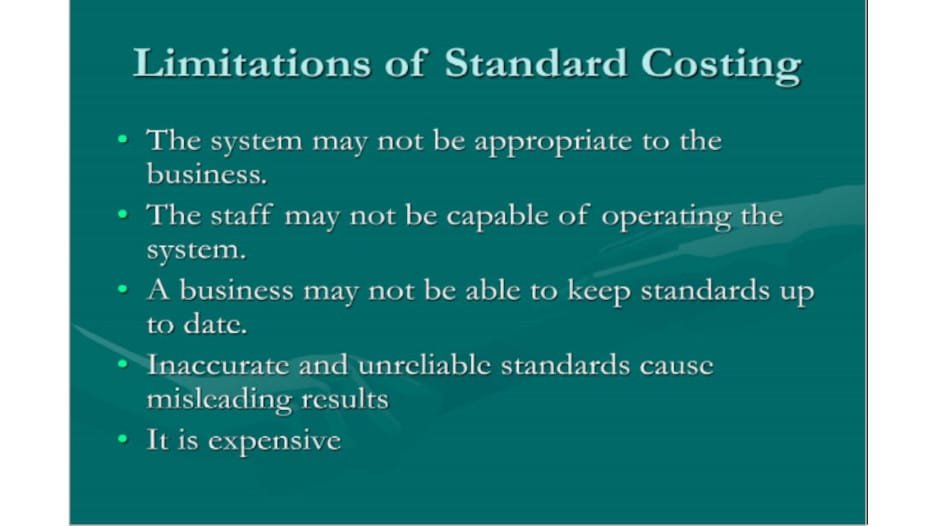

Limitations and Constraints

Whilst standard costing techniques have been in use for many years across western countries, recent developments in business are making their application and utility increasingly doubtful.

Standard setting by itself is a difficult task, more so in case of items and services that are not standardised. Whilst change in common inventory methods like LIFO or FIFO can make the material costs of different periods difficult to compare, events like introduction of performance bonuses or changes in inflation indexed wages can cause inordinate variances between actual and standard labour costs. Inadequate utilisation of capacity or labour absenteeism on account of unavoidable circumstances could also be causal in non-fulfilment of standards.

The tremendous volatility of prices in modern day business, caused by a range of factors, (many of which did not exist even a decade ago) make the setting of standards difficult and often make already set standards substantially irrelevant. Such standards may require to be altered to provide for organisational or environmental changes. Standard costs are likely to become inaccurate in case of alterations in economic situation, technology or methods of production and will cease to be efficient control tools. Such circumstances, which make standard setting difficult and alteration of standards routine, make standard costing an inordinately cumbersome and expensive proposition and unsuitable for many small and medium organisations.

Constant changes in standards result in the irrelevance of predetermined standards as comparative yardsticks. 9Whilst the implementation of basic standard could in such circumstances provide stable comparison measures, such standards could prove to be unsatisfactory in times of technological advancement and change in working methods and conditions.

Standard costing is also considered by many modern day experts to be inconsistent with modern inventory practices like Just in Time Management, which require numerous material inflows in small lots, Kaizen and Total Quality Management (TQM).

The modern day philosophy of continuous improvement, represented by techniques like JIT and TQM is becoming accepted to be most suitable for coping with the current environment of constant change and the demand for innovative and high quality products, as well as services, for retention and enhancement of market share. Standard costing, which is being viewed as a static and cumbersome process, is considered by many experts, especially those inclined towards lean production methods, to be focussed on short term results, to the detriment of action that is aimed at improving long term business profitability and efficiency.

Conclusions

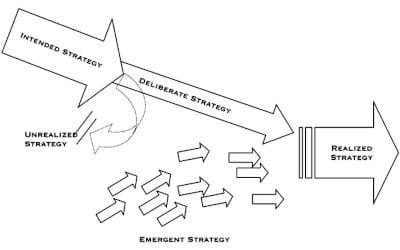

It can be argued, in defence of standard costing, that it provides a strong planning method as well an efficient system for performance monitoring at the macro level, which enables middle and senior managers to periodically view the big picture. It can thus continue to play an important organisational role, even in JIT environment, if other relevant performance indicators can be utilised to steer and assess junior managers.

References

Bhimani, A. (2003). Management Accounting in the Digital Economy, Oxford: Oxford University Press

CIMA, (2009), Retrieved December 3, 2009 from www.cimaglobal.com

Hurt, R. L. (2001). Management Accounting: Analysis and Interpretation. Issues in Accounting Education, 16(3), 513

Warren, C., Reeve, J., & Duchac, J., (2008), Managerial Accounting, South-Western College Publishers

More From This Category

Does Capital Structure Matter

The capital structure of a modern corporation is, at its rudimentary level, determined by the organisational need for long-term funds and its satisfaction through two specific long-term capital sources, i.e. shareholder-provided equity and long-term debt from diverse external agencies (Damodaran, 2004). These sources, with specific regard to joint stock companies, retain their identity but assume different shapes.

Principles and Applications of Taylorism

The work of Fredrick Taylor, (1856 – 1915), widely known as the founder of scientific management, has been instrumental in shaping management thought and action in diverse areas of business and industry for the major part of the 20th century.

Strategic Analysis: The Case of Sainsbury’s Plc

The application of strategic analytical models to an organisation and the evaluation of their results helps in the generation of a comprehensive corporate strategy.

Deliberate and Emergent Schools for Strategy

Deliberate and Emergent strategies are situated at two ends of the strategic continuum, but have been used with success by modern organisations.

Strategy Formulation and Management of Change Application to a Healthcare Organisation

The application of strategy to a particular business sector makes it easier to understand its practical implications than a generalised discussion.

Accounting is a Strategic Business Tool

Several experts, from the 1980s onward, have focused on the importance of strategic management accounting and presented strong cases for its adoption.

0 Comments